Continuous updates and training on compliance requirements help real estate investment bookkeeping experts stay current with changing laws and standards. At Invensis, we have more than 24 years of experience in streamlining real estate accounting and bookkeeping processes. Whether you manage a single property or a large portfolio, Invensis offers comprehensive solutions that cater to your specific requirements. We support them with month-end financial reporting, debt covenant reporting, document administration, cost segregation, property management accounting administration, and more. With accurate financial reporting, investors can make informed decisions, leading to cost savings that are more valuable than finding hidden treasure.

Bookkeeping & Accounting Automation

By outsourcing these tasks to experts in real estate accounting, agents can focus on closing deals and growing their business. Services like managing finances, tracking expenses, and preparing reports can all be handled efficiently by specialized bookkeepers. Many real estate agents must track their income and expenses to ensure financial health. Proper accounting and bookkeeping can help manage cash flow, track property sales, and prepare for tax time. It can handle your books, track income and expenses, and ensure compliance with tax regulations.

- Allow us to tell you why we think you choosing us could be the best decision for you.

- Inadequate internal resources can result in delays, inaccuracies, and non-compliance risks.

- Stessa helps both novice and sophisticated investors make informed decisions about their property portfolio.

- Gain a competitive edge in the market and enhance customer satisfaction by letting REA manage your property accounting.

- Encryption, multi-factor authentication, and secure cloud storage are essential to protect sensitive financial data.

Bookkeeping services for real estate agents

With a proven track record of servicing Residential, Commercial, and Industrial real estate businesses, get the benefit of endless innovation that is designed to deliver solutions for the future. Most balance sheets carry the asset value of a rental property at the original cost. bookkeeping for realtors Over the years, houses tend to increase in value due to appreciation, so carrying the property at the purchase price understates the true amount of owner’s equity. With a relatively simple business, you might not need to invest in complex bookkeeping software. You could just track your expenses using a simple spreadsheet in a program like Excel or Google Sheets. How you report income and pay taxes as a real estate agent is all based on the tax regulations in your state and at the federal level.

Real Estate Accounting & Bookkeeping Services

Ensuring compliance helps avoid penalties and ensures your financial reports are correct. We give you the levers to control costs and generate more cashflow with a team of experts focused on maximizing ROI and increasing margin. Whether it’s bookkeeping, accounting, or both, RealCount becomes your on-demand accounting department, helping you optimize your financial performance. We https://www.bookstime.com/ understand that each client’s needs are unique, which is why we offer customized solutions to suit your specific requirements. Our team works collaboratively with you to understand your business and tailor our services accordingly, ensuring that you receive the most appropriate and effective bookkeeping support. Managing the financials across multiple properties, including varying rent schedules, maintenance costs, and tax obligations, can be challenging.

Utilizing bookkeeping software to streamline financial transactions

Their team is really responsive; they assist with any complicated accounting concerns. They keep our books up to date, unearned revenue and we also enrolled in the plan that includes income tax filing, which is excellent. The service is outstanding, and all of my requests are responded to promptly. I am completely certain that they will assist me in maintaining the figures, allowing me to interact with clients and build our management business. Having up-to-date accurate books is essential for you to make the right financial decisions to maximize your cash. Real estate bookkeeping is essential if you want to keep up with your books and report the right kind of transactions at the end of the year.

- Velan has been able to develop alongside us as we transitioned from a single product to a multi-product business.

- But there’s only one Velan, amidst the sea of options, that offers an unparalleled quality of services.

- All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice.

- By utilizing rental income bookkeeping and real estate reporting, property owners can achieve clarity in their financial statements.

- Outsourcing bookkeeping solutions for real estate investors helps simplify this process.

Individuals & Companies Include

A dedicated bookkeeper or real estate CPA who specializes in real estate can assist in managing your accounting needs and ensuring that your financial records are accurately maintained. Our commitment to providing exceptional bookkeeping and accounting services is guided by maintaining the highest standards. Goes without saying there are umpteen companies providing similar services to tens of thousands of real estate business owners. But there’s only one Velan, amidst the sea of options, that offers an unparalleled quality of services. Allow us to tell you why we think you choosing us could be the best decision for you.

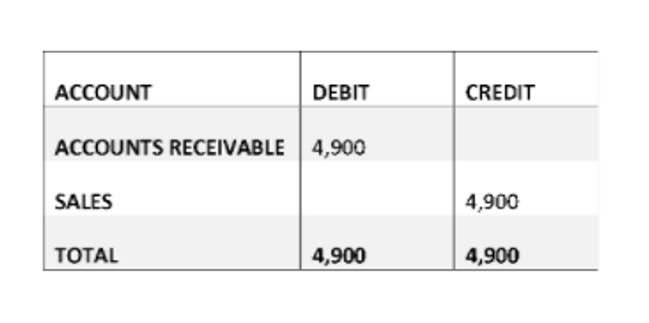

Such operations can be done manually or through accounting and bookkeeping software for real estate business. Proper bookkeeping is essential for realtors and real estate agents to accurately track their income and expenses. It allows them to analyze their financial performance, make informed business decisions, and ensure compliance with tax regulations.